Please note: As required by the European Securities and Markets Authority (ESMA), binary and digital options trading is only available to clients qualified as professional clients.

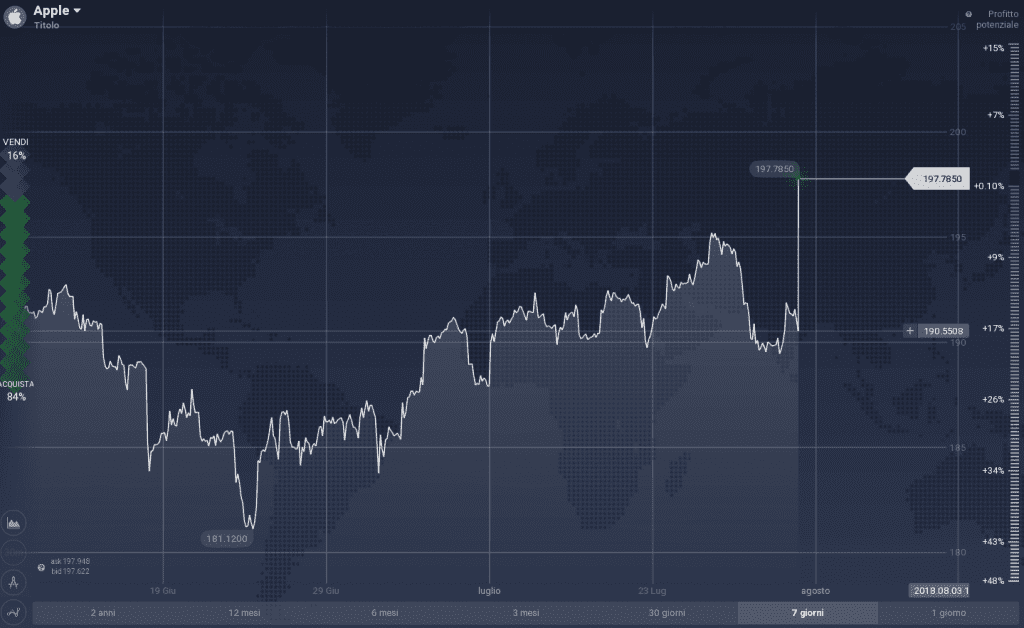

Apple does not disappoint market expectations and releases good financial data for the fiscal quarter ended June 30. The share rises by almost 5% compared to yesterday's close, coming close to $ 200. The company, moreover, because of these data, is also close to the psychological limit of the trillion dollars of capitalization, a goal reached only by PetroChina about ten years ago.

From the graphical point of view, before analyzing the new economic and financial estimates of the company, it is clear that the threshold of 200 $ constitutes a strong resistance. If it should be broken and the price should remain above this threshold for a few trading days, it is very likely to rise up to 210 $.

Otherwise you could retest quota 195 $. The financial numbers, as anticipated, are very good. The bitten apple company, in fact, recorded a turnover of 53.3 billion dollars, with a growth of 17% compared to the same period last year. Apple beats analysts' estimates, which had calculated lower target estimates of at least 20%, among other things, not confident that Apple could record a further quarter of sustained growth.

Analyzing the numbers more deeply it is clear how the business linked to the hardware grows but not by much, the sales of the iPhone, for example, have remained substantially at the stake but the turnover of the division has nevertheless increased thanks to the higher unit cost per device sold , which reached around $ 724!

Hope you enjoyed today's tutorial for fast profits using MACD and Exponential Moving Average (EMA) indicators. This easy strategy is great for both Binary ...

WE RECOMMEND THE VIDEO: 5 MINUTE PROFIT Strategy using MACD & EMA (FOREX / BINARY)

Among the most successful devices in the period we find the AirPods and Apple Watch, which are part of the subcategory of "wearable" hardware. Macs, on the other hand, had a 12% drop in revenues compared to last year. It is likely that many potential buyers, however, are waiting for the new outbound lineup shortly.

The company has also declared an extraordinary dividend of $ 0.73 per share, which will be paid from mid-August 2018 onwards. The decision to remunerate shareholders through dividends is questionable, also because of the implications in terms of double taxation and bureaucracy that it generates. It would have been better, especially for international investors not resident in the United States, to take the buyback route.

General Risk Notice

The financial services provided by this website carry a high level of risk and can lead to the loss of all your funds. You should never invest money that you can not afford to lose

Source: IQOption blog 2018-08-01 15:01:34

* This is redirection to the official website where you can sign up to IQ Option broker